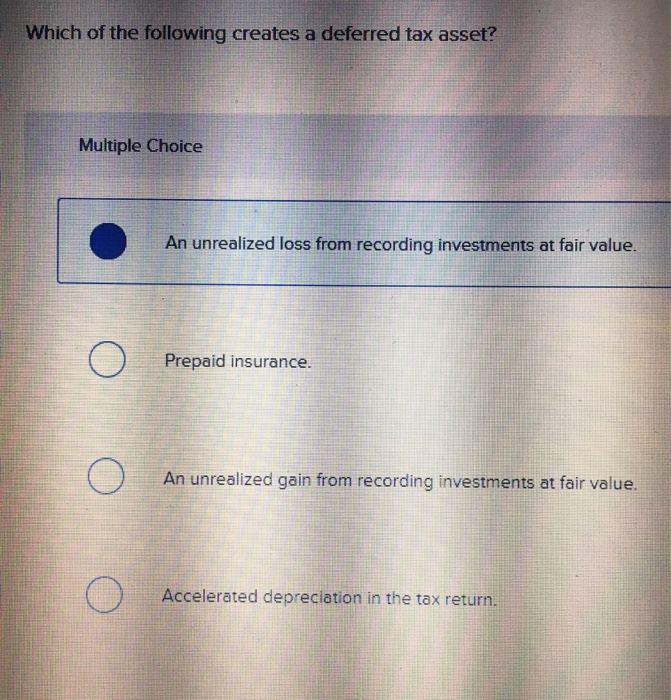

Which of the following creates a deferred tax liability future taxable amount. Which of the following creates a deferred tax asset.

Solved Which Of The Following Creates A Deferred Tax Asset Chegg Com

0 Accelerated depreciation in the tax return.

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

. Which of the following creates a deferred tax asset. Rent received in advance. Which temporary difference would result in a deferred tax asset.

This money will. Deferred tax liabilities and assets shall be classified as current or noncurrent on the balance sheet based on the classification of the asset or liability giving rise to the deferred tax item. Selling equipment on an installment note.

Temporary difference is the timing difference which if it is recognized as the asset or liability in this year it will be reversed back in the future years in the balance sheet. All current and noncurrent deferred tax assets shall be offset and presenting as a single amount on the balance sheet. Accelerated depreciation for tax reporting.

In that sense the loss is an asset. This can be leveraged to create deferred tax assets. So deferred tax asset is created which is adjusted with the deferred tax liability of last year.

Or in the income statement if it is recognized as income or expense in this year in the. You can learn more about accounting from the following articles. We will have a deductible temporary difference when.

There are two methods for calculating depreciation. Income tax payable taxable profit 30 650000 30 195000. Subscriptions delivered for which customers had paid in advance D.

Receiving interest from a municipal bond. A B C D None of these. Forgetting from short-term memory is.

Revenues from installment sales of property reported on financial statements in prior years and currently reported in the tax return create deferred tax assets. A deferred tax liability or asset is created when there are temporary differences PermanentTemporary Differences in Tax Accounting Permanent differences are created when theres a discrepancy between pre-tax book income and taxable income under tax returns and tax between book tax and actual income tax. Deferred Tax Asset income tax payable income tax expense.

MCQ-14857 Which of the following would create a deferred tax asset. This article has been a guide to Deferred Tax Assets. An unrealized loss from recording investments at fair value B.

A deferred tax asset is often created when taxes are paid or carried forward. Which of the following creates a deferred tax asset. MACRS depreciation typically creates deferred tax liabilities early in.

Any tax on the earned revenue is imposed before time. Deferred tax asset refers to the company that is created when there arises a difference in timing of tax payment due to different accounting treatments by different laws or it can also arise when organization has overpaid the taxes by way of advance tax or tax deductions which results in less tax liability in future and the same is opposite of the. One straightforward example of a deferred tax asset is the carryover of losses.

Which of the following creates a deferred tax asset future deductible amount. Using the modified accelerated cost recovery system of depreciation. Such a line item asset can be found when a business overpays its taxes.

Marvel destroyer vs hulk illinois wage garnishment worksheet salomon snowboard packages. Which of the following usually results in an increase in a deferred tax asset. A Level of Learning.

The balance of Rs. Carrying value of an asset in the accounting base is smaller than its tax base or. Revenue collected in advance.

Deferred Tax Asset 195000 180000 15000. As the income tax payable is greater than income tax there will be deferred tax assets. Owing to the following reasons DTA had originated.

If a business incurs a loss in a financial year it usually is entitled to use that loss in order to lower its taxable income in the following years. A B C D Installment sales. In other words deductible temporary difference creates deferred tax asset.

A deferred tax asset is an item on a companys balance sheet that reduces its taxable income in the future. Taxable temporary difference creates deferred tax liability while deductible temporary difference creates deferred tax asset. You can think of it as paying part of your taxes in advance deferred tax asset or paying additional taxes at a future date deferred tax liability.

Which of the following temporary differences creates a. Definition of Deferred Tax Asset. There are numerous types of transactions that can.

Depreciating your assets with higher expenses in the beginning helps in lowering the tax liabilities. Which of the following creates a deferred tax asset future deductible amount. Accelerated depreciation in the tax return.

Requiring prepayment for service contracts. Which of the following creates a deferred tax liability future taxable amount. Choice C is correct.

Accounting questions and answers. Deferred tax assets Blooms. Accelerated depreciation for tax reporting and straight-line depreciation for financial reporting B.

A part of deferred tax is a deferred tax asset which is commonly known as DTA. The taxable profit is 650000 so we need to calculate income tax payable as following. Rent collected in advance results in deferred tax assets.

The benefit of a deferred tax asset is that it lowers a companys future liability. A B C D None of these. An unrealized gain from recording investments at fair value D.

Revenue collected in advance. The tax department takes expenses before time. A B C D Installment sales.

A deferred tax asset is a business tax credit for future taxes and a deferred tax liability means the business has a tax debt that will need to be paid in the future. The straight-line method and the double depreciation method. 1 Easy Learning Objective.

Multiple Choice 0 An unrealized gain from recording investments at fair value. Of the following temporary differences which one ordinarily creates a deferred tax asset. Here we discuss the Top 7 examples calculation of Deferred tax assets including business loss warranties bad debts expenses depreciation method and depreciation rates etc.

Doing this converts the loss into a deferred tax asset. O Rent collected in advance. Deductible temporary difference is the timing difference that creates tax asset which the company can deduct in the future.

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

0 Comments